ENTREPRENEURS, IF YOU HAVE EVER FACED REJECTION BEFORE...

LET US ESTABLISH YOUR PERSONAL CREDIT, BUSINESS CREDIT, AND SECURE THE FINANCING YOU NEED TO GROW YOUR BUSINESS WITH TS CONSULTATIONS' CREDIT REPAIR & FUNDING SYSTEM

Our Credit Repair Service assists entrepreneurs and business owners in improving their personal and business credit profiles, essential for starting or expanding their businesses by establishing financial credibility for securing loans, attracting investors, and fostering business growth.

50,000+ clients

We restore your personal credit, solidify your business credit, and unlock immediate access to funding and credit approvals with our Credit Repair & Funding System.

DISCOVER HOW YOU CAN GET FUNDED WITH OUR Credit Repair & Funding System

Watch The Video Below & Discover How Easy Getting your business funding is Using TS Consultations' Credit Repair & Funding System

Get Faster Growth In Less Time With A Business That Has The Ability To Fund Itself…

By focusing on enhancing both your personal credit and ensuring that your Personal and Business credit profile includes vital data points, we aim to empower your Business to secure the necessary funding it requires to thrive

Business Credit Builder

Remove uncertainty and confusion for reliable, consistent funding

Get 10X - 100X higher limits than consumer credit, plus get financing in a fraction of the time it would take for you to build business credit on your own.

FUNDABILITY SCORE

Put a stop to constant denials

Discover what’s getting you denied—and how to fix it—so you’ll know you’re approved before you even apply

3 Things OUR Credit Repair & Funding System Does For Your Business:

Improves your Fundability

Identify the roadblocks and factors that hinder your fundability to get you money

Accelerate Your Business Credit Building

Helps you build fast business credit so your Barber Business that has the ability to fund itself.

Gives You Access to 1000+ Funding Sources

Matches you with every legitimate

type of funding that’s available today, all in one place.

Try Our Credit Repair & Funding System for yourself

CREDIT REPAIRING

Rebuild, Repair & Improve Your Credit Score!

Grow your Business faster with accounting, payroll, virtual offices, software, email marketing and CRMs, phone systems, web design, data and analytics, and much more.

HOW WE WORK

How Our Credit Repair and Restoration Works

Review Credit Reports

We start with a detailed analysis of your credit report to pinpoint issues, then create a tailored plan to address and resolve them.

Fix or Dispute Errors

We begin by thoroughly analyzing your credit report to identify errors and discrepancies. Our team then disputes these inaccuracies with the credit bureaus and works to have them corrected, while guiding you through effective strategies to rebuild your credit.

Pay Your Bills On Time

We help you develop a plan to consistently pay your bills on time, which is crucial for improving your credit score. Our team provides reminders and strategies to ensure you stay on track, boosting your credit profile with every on-time payment.

Pay Down Outstanding

We assist you in creating a strategic plan to pay down outstanding debts, which helps improve your credit score. Our experts provide personalized advice and support to manage your payments effectively and reduce your debt load.

Keep Old Cards

We guide you on how to manage and keep your old credit cards open, as longer credit histories can positively impact your credit score. Our team provides strategies to maintain these accounts effectively, helping you build a stronger credit profile over time.

Watch the Progress

We continuously monitor your credit progress and provide regular updates on improvements. Our team tracks changes and adjusts strategies as needed to ensure you stay on track towards achieving your financial goals.

CREDIT MASTERY BUREAU INSIGHTS

Control the data that lenders see to make decisions about you

Get access to the same data only available to lenders, so you can see what they see, fix errors holding you back from getting financed, and get more loan approvals.

RESOURCE MARKET

Access top companies that 5-and 6-figure Business owners use to grow

Grow your Business faster with accounting, payroll, virtual offices, software, email marketing and CRMs, phone systems, web design, data and analytics, and much more.

CONCIERGE COACHING

Get unlimited, one-on-one support

Our expert Business Credit Advisors provide a complete concierge service offering comprehensive, one-on-one support to help you bypass any potential roadblocks and get the most money at the best terms possible

STILL NOT SURE?

Frequently Asked Questions

What is credit monitoring?

Credit monitoring continuously tracks an individual’s credit report and score, providing real-time alerts about changes or suspicious activities.

Why is credit monitoring needed?

Early Detection: Quickly identifies issues like identity theft or inaccuracies, allowing us to address them before they impact funding opportunities.

Maintaining Creditworthiness: Helps clients stay informed about their credit status, enabling proactive steps to improve or maintain their scores.

Informed Decisions: Access to ongoing credit information allows clients to make better financial choices regarding loans and credit lines.

Dispute Support: Timely alerts assist in resolving discrepancies efficiently, protecting clients' credit profiles.

Building Trust: Proactive credit management enhances clients' credibility with lenders, improving their chances of securing favorable funding.

How long will it take to see results with my credit score?

Out credit repair services are delivering results in as little as 20 days! We ask to hit it a full 30-35 days to see maximum results per disputing round

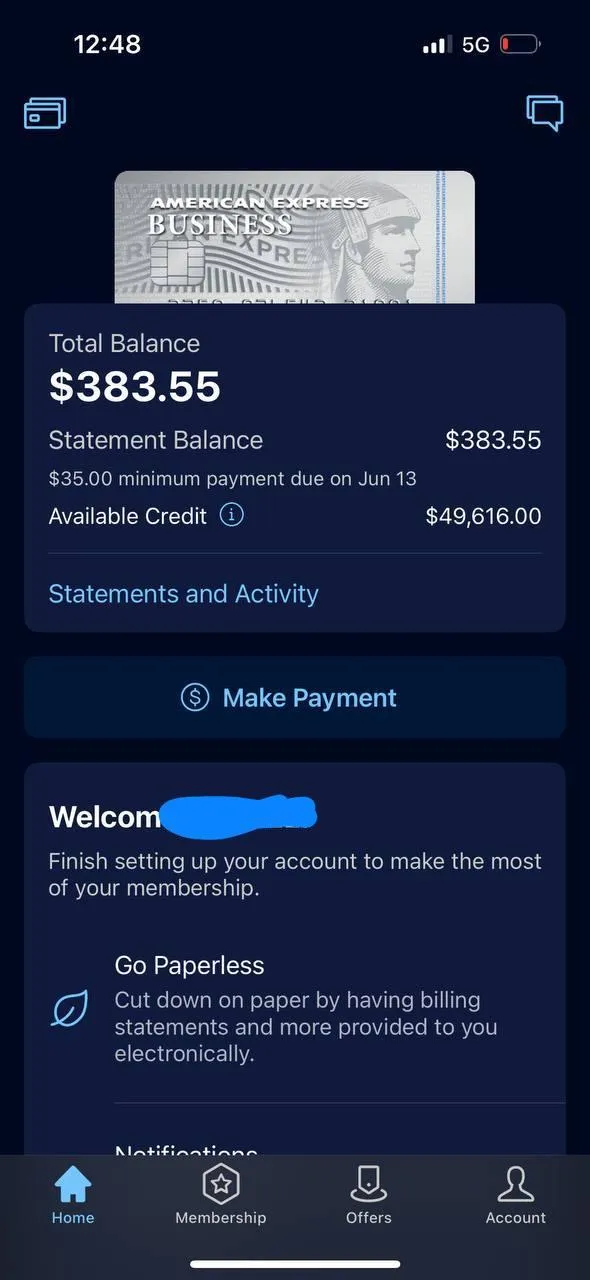

How long will it take to get Business Credit?

You can qualify for real usable vendor credit immediately. You’ll then start to qualify for store credit within 60-90 days that doesn’t require a personal credit check or personal guarantee. Within 6 months, you should have access to $50,000 in real usable credit, including Visa and MasterCard accounts. You can then continue to build $100,000-$250,000 or higher in business credit within a year to two. You can also gain access to cash funding programs within a couple of months or less.

What is Fundability?

Your credibility (or legitimacy) is fairly close to Fundability, meaning that a business doesn’t appear to be ‘fly by night’. It’s about setting up your business the right way so that creditors and lenders WANT to loan you money. Fundability also encompasses the ability to pay back any extended credit or loans.

What is a Fundability Score?

Your Fundability Score is a measure of how likely it is you’ll get approved for credit and funding right now.

Can I build business credit with Fundability?

Yes, any business can build business credit with Fundability. Fundability is a complex process, but we’ve made it super simple to ensure your success with building business credit. Fundability is what gives you access to the loans and credit lines you need to grow your business in the shortest amount of time possible.

Is Fundability for new Barber Business?

Fundability is for new and established businesses alike–large or small. Every business should have Fundability to ensure it can meet the demands that come with running a business: fast growth, slow seasons, changes in the economy, market fluctuations, unexpected emergencies and business opportunities that often arise at any given moment.

Can I use Fundability even if I’ve been denied before?

Absolutely! That’s what Fundability is designed to do–help any business get the money and credit they need to grow, even if you’ve been denied before.

How long will it take me to build my Business credit?

Building business credit on your own can take years. Even when working with a specialist, it can take as long as 2-3 years. With Fundability, on average, it takes 6-9 months to build strong business credit. In only 12 months, your business can actually fund itself.

How long does it take to use the Credit Repair & Funding System to get cash?

Fundability™ is a software that allows you to go at your own pace. How long it takes to get funding is partly dependent upon how fast you move through the system. Your ability to access cash is also dependent upon how fundable your business is right out of the gate, the type of loan you’re looking to qualify for and how much money you’re looking to get. On average, our customers are gaining access to cash funding programs within a couple of months or less.

See If You’re Eligible

Credit Advisors offer a complete concierge service to provide

comprehensive, one-on-one support to help you bypass any

potential roadblocks and get the most money

at the best terms possible.

GET FUNDED TODAY!!!

PRICING PLAN

Choose Your Best Plan To Get Our Services

Starter Plan

Bureau Audit Analysis

Client Portal Access

Credit Education

Credit Business

Customer support

Basic Plan

Bureau Audit Analysis

Client Portal Access

Credit Education

Credit Business

Customer support

Premium Plan

Bureau Audit Analysis

Client Portal Access

Credit Education

Credit Business

Customer support

TESTIMONIALS

Our Client Reviews

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla ut nisi varius, convallis justo placerat, gravida enim. Nulla et hendrerit ligula. Donec sagittis, turpis ut aliquet imperdiet, massa turpis rhoncus elit, quis iaculis eros velit a elit.

John Beli

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla ut nisi varius, convallis justo placerat, gravida enim. Nulla et hendrerit ligula. Donec sagittis, turpis ut aliquet imperdiet, massa turpis rhoncus elit, quis iaculis eros velit a elit.

Holing Tums

Developer